Understanding how travellers behave online is vital information for advertisers, particularly if they want to perform better online. The first morning workshop at this year’s Phocuswright conference gave great insight into The British Traveller’s Path to Purchase. The workshop was presented by Wendy Olson Killion of Expedia Media Solutions, and was based on the results of a comScore study on travel path to purchase in the United Kingdom.

Methodology

comScore blended online travel behavioural data with data collected through a custom survey.

Key Facts

- 75% of digital UK users consume travel content

- 2.4 billion minutes spent on digital travel content in the UK, a 44% increase year on year

- More UK users now engage with travel content on mobile devices than on desktop devices. Half of smartphone owners and over three in five tablet owners used their mobile devices to plan trips.

- Over half of online travel bookers started with multiple destinations in mind.

Upwardly Mobile

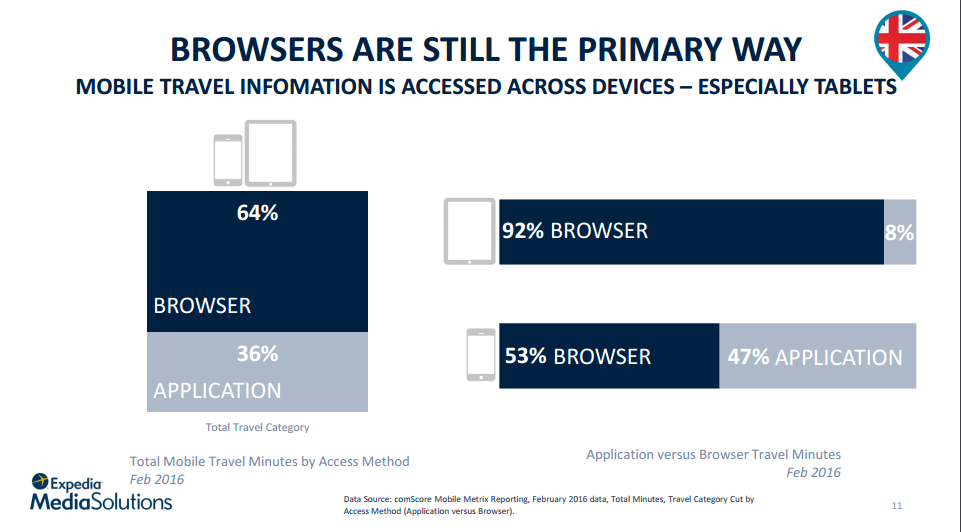

Tablets continue to be a big piece of the pie for UK digital users accessing travel content. As tablets become less prevalent in other markets, and smartphones screens increase in size, it will be interesting to track this statistic over time. Browsers continue to be the most popular way to access travel content on mobile devices, particularly on tablets. Browsers win out on Smartphones too, but the split is fairly even with apps in this instance.

In the Funnel

Travel continues to be seen as a considered and time-consuming purchase for online travel bookers. On average over 3 resources were accessed throughout the decision process, with millennials using 16% more resources. OTAs, hotel sites and airline sites are used throughout the booking path while search engines and family/friend recommendations were used mostly near the beginning of the path.

Out in Front

Over half (54%) of online travel bookers started with multiple destinations in mind. This represents a potential opportunity for online advertisers to try to influence the decision making process at the top of the funnel, in fact the study found that advertising influenced the destination decisions for 3 in 10 online travel bookers who were considering more than one destination. In the case of travel, the study found that only 13% of online travel bookers used social media in their travel research process.

Downward Slide

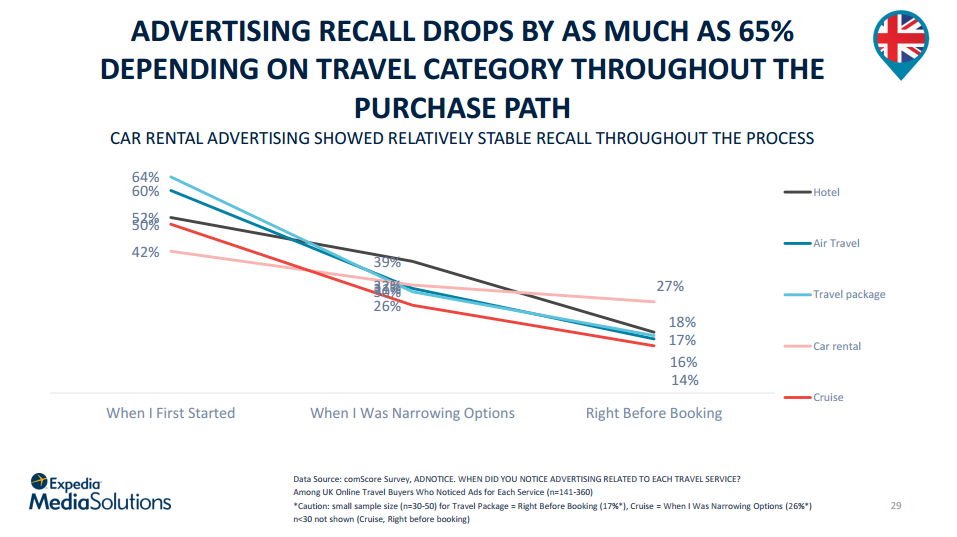

The opportunity for travel ads to stand out appears to be greatest at the top of the funnel.

- Advertising recall drops by as much as 65% depending on travel category from the start of the process to just before booking.

- Airlines and OTA ads have the highest share of voice when the advertising recall is strongest. Both groups decrease share right before booking which coincides with lower recall from bookers.

- Travel advertising impressions increased by more than four-fold during the online booking path.

- Millennials are 25%+ more likely to notice travel ads compared to baby boomers or Gen-X

Conclusion

The presentation confirmed that the UK digital travel industry is seeing explosive growth in travel content engagement. Content consumption on mobile is outpacing desktop, and consumers in general are moving more fluidly across devices.

A key takeaway from Wendy’s presentation was that over half of online travel bookers began their purchase journey with multiple destinations in mind. Therefore the opportunity to influence and maintain share of voice for travel marketers starts at the point of inspiration where ad recall is highest and penetration is the lowest.

Download the full study here.

Want to discover more about travel industry trends? Find out more about upcoming Phocuswright events.